Get Your Free Estimate Now

"*" indicates required fields

When comparing the Cost of living Vancouver vs Surrey 2026, most people look only at rent or home prices. That approach misses the bigger picture. The real question is, is it cheaper to live in Surrey or Vancouver once monthly expenses are included?

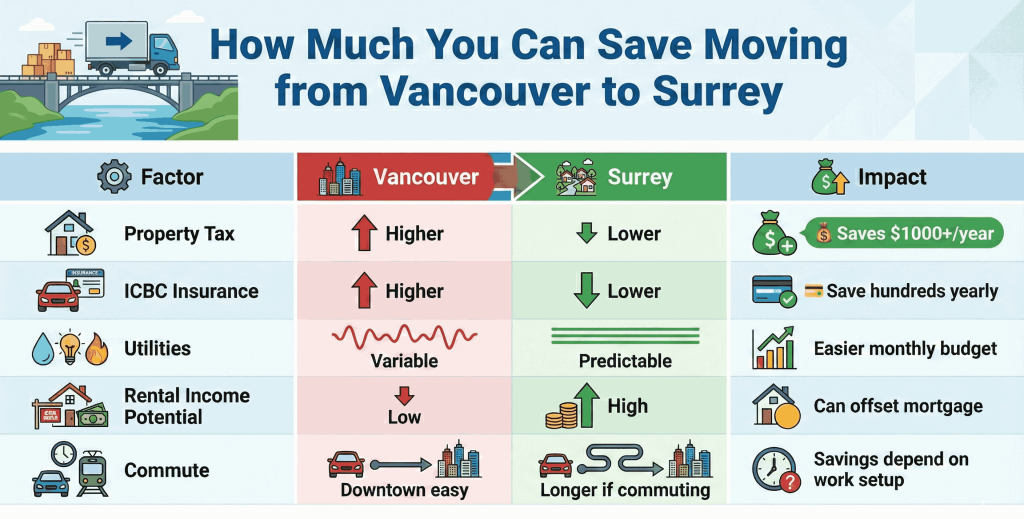

Rent is just one part of the equation. Property taxes, car insurance, utilities, and commuting costs quietly shape your budget every month. These recurring expenses directly affect your disposable income, especially in a region facing Metro Vancouver housing affordability pressures.

If you are moving to Surrey from Vancouver, financial breakdown matters more than headline prices. A deeper look often reveals savings that are not obvious at first glance. That is where the Hidden 15% rule begins to make sense.

Vancouver vs Surrey Property Tax Comparison (2025–2026)

A real Surrey vs Vancouver property tax comparison goes beyond rates on paper. What matters is how much you actually pay every year.

1. What the Mill Rate Means in Real Numbers

While rates change slightly each year, Vancouver’s residential rate is generally higher than Surrey property tax mill rates 2026. On a $1,000,000 assessed home, even a 0.15%–0.25% difference can mean $1,500–$2,500 more per year. Over five years, that is $7,500–$12,500 from your pocket without any mortgage change.

2. Condo vs Detached Reality

Condo buyers in Vancouver often face higher strata fees, sometimes $450–$800 monthly in older or amenity-heavy buildings. In Surrey, many newer condos range lower, though amenities differ. Detached homes remove strata fees but increase direct maintenance costs. This is where strata fees vs freehold maintenance becomes a practical budgeting decision.

3. Vancouver Empty Homes Tax vs Surrey

The Vancouver empty homes tax vs Surrey difference also matters. Vancouver charges additional tax on vacant properties, which can significantly increase annual ownership costs. Surrey does not apply the same vacancy pressure, offering more flexibility for temporary relocations or investment strategy.

Practical Impact

Lower annual taxes mean stronger cash flow, better long-term affordability, and more predictable ownership costs in Surrey.

ICBC Insurance Zones: How Much Difference Does Car Insurance Really Make?

Car insurance plays a bigger role in the cost of living Vancouver vs Surrey 2026 than most people expect. ICBC does not price insurance only on your driving record or vehicle. Location matters.

ICBC uses a car insurance territory factor (ICBC term), meaning your postal code directly affects your premium and overall insurance costs. Areas with higher traffic density and claim frequency are considered higher risk. Vancouver generally falls into a higher-risk category than Surrey. This means the same driver, with the same car and coverage, can pay more simply because the vehicle is registered in Vancouver. This is why ICBC insurance rates Surrey vs Vancouver are rarely identical.

In practical terms, the difference often shows up as a few hundred dollars per year. Over multiple years, that adds up to thousands without changing vehicles or coverage. However, commuters should be careful. If you move to Surrey but drive daily into Vancouver, fuel costs and time loss can offset insurance savings.

The real saving comes when lower premiums align with reduced driving distance.

Utility Bills Breakdown: Surrey vs Vancouver (2026 Reality)

When people compare utility rates Surrey vs Vancouver 2026, they often expect large gaps in electricity or gas bills. In reality, BC Hydro pricing is almost the same across the region, and FortisBC rates Lower Mainland apply equally in both cities. This means power and gas costs usually stay consistent after a move.

Where the difference becomes practical is water and sewer billing. Surrey flat rate utilities vs metered systems in Vancouver change how predictable your bills feel. Vancouver homes commonly pay based on water usage, so larger households or frequent outdoor use can push costs higher. In Surrey, many properties rely on flat annual charges, which smooth monthly budgeting.

Housing type also matters. Condos may include heat or water within strata fees, while detached homes pay utilities separately. Over a year, predictability rather than price is what most homeowners actually notice.

How Secondary Suite Income Makes Surrey Homes Financially Smarter

Surrey offers a practical advantage that many Vancouver homeowners do not have: legal secondary suites. Basement rentals are more common and easier to permit, which directly affects monthly cash flow. Secondary suite rental income Surrey often helps offset mortgage payments rather than just covering utilities.

In Vancouver, stricter zoning and higher compliance costs limit who can legally rent out part of their home. Even when allowed, Vancouver rents are higher, but so are property prices, which reduces the net mortgage offset. This is why Vancouver to Surrey relocation savings show up more clearly on a monthly basis.

For families and long term owners, rental income changes the equation. A consistent basement rental can increase disposable income without changing salary, making ownership in Surrey financially easier to sustain over time steadily.

Real Monthly Savings Calculation: The Hidden 15% Rule

The Hidden 15% rule becomes clear only when monthly costs are viewed together. Individually, property tax savings, lower ICBC premiums, and predictable utilities may seem minor. Combined, they quietly reshape monthly cash flow.

Illustrative example (hypothetical):

A $1,000,000 home in Vancouver may carry around $450 per month in property tax when annual costs are divided. Higher ICBC territory risk can add roughly $50–$70 monthly, while metered water usage adds variability. With no secondary suite, these costs stack.

In Surrey, lower property tax reduces the monthly figure closer to $350. Insurance premiums ease due to territory factors, utilities remain predictable, and secondary suite rental income Surrey can offset a large portion of the mortgage. Even after adjusting for commuting costs, many households notice a clear disposable income difference when comparing living in Surrey versus Vancouver.

This is why a proper moving to Surrey from Vancouver financial breakdown often answers the question: is it cheaper to live in Surrey or Vancouver through monthly math, not rent alone.

Who Should Actually Move to Surrey (And Who Shouldn’t)

This decision depends on lifestyle, work location, and how monthly costs actually behave.

- Families needing larger homes benefit most from the Cost of living Vancouver vs Surrey 2026 difference through lower taxes and suite income.

- Car owners driving locally in Surrey usually see gains after proper commuter cost calculation and reduced congestion.

- Remote or hybrid workers protect insurance savings and fuel budgets by limiting daily travel.

- Downtown dependent professionals commuting daily to Vancouver often lose savings to fuel parking and time.

- For Metro Vancouver housing affordability concerns, Surrey fits better, but walkability focused lifestyles may favor Vancouver. Personal commute tolerance ultimately decides whether the move feels financially worth it long-term.

Before You Move: Plan the Financial Side Properly

Once you understand the numbers behind Vancouver to Surrey relocation savings, the next step is planning the move itself. Financial savings only work if the transition is smooth and costs are controlled.

Start by calculating deposits, moving company charges, temporary overlap rent or mortgage payments, and utility setup fees. Many people ignore these short term expenses, which reduces first year savings. If you are completing a full moving to Surrey from Vancouver financial breakdown, include one time costs in your math.

Timing also matters. Selling in Vancouver and buying in Surrey during different market cycles can change your final outcome. Locking mortgage rates early and confirming secondary suite compliance before purchase protects long term cash flow.

Once your savings strategy is clear, planning the logistics becomes easier. A structured relocation plan ensures your financial advantage is not lost during the move.

Final Takeaway: What Should You Do Next?

The Hidden 15% rule shows that real savings are rarely obvious at first glance. When property tax, insurance, utilities, and rental income are viewed together, the monthly difference between Vancouver and Surrey becomes clearer. For many households, the decision is not about earning more, but about keeping more.

If your lifestyle allows flexibility in commute and housing type, Surrey often provides stronger long-term cash flow without changing income. However, every move depends on personal priorities, work location, and daily routine.

Once you have calculated your numbers, the next step is planning the move itself. Understanding costs is only half the equation. Executing the relocation properly is what turns financial insight into real savings.

Contact Us

Get access to a variety of moving and storage Canada solutions:

Contact Our team

Call Professional Movers Canada or fill out our free moving quote form.

Get Your Quote & Plan

Receive an obligation-free estimate and a detailed plan of action for your move.

Enjoy a Professional Move

Leave all the vexing tasks of relocation to our skilled Canada movers.